Income Protection Insurance

Protect your lifestyle in the event of sickness.

- Comprehensive cover bespoke to your needs.

- Competitive prices from leading industries.

- Protection and peace of mind.

Your first home

If you’re reading this article probably because you’re considering buying your first home, and you don’t know where to start. You may have seen mortgage ads everywhere, but you don’t quite understand what they all mean. In fact, the entire process of getting first time buyer mortgages can be quite intimidating and scary, especially if you’ve never bought a home before and have no idea how the whole thing works.

First time buyer mortgage guides

We have a vast number of Guides for “First Time Buyers in the guides section of our website.

First time buyer Stamp Duty Calculator

Our “First Time Stamp Duty Calculator can help you an indication of stamp duty costs as a First Time Buyer. These are used as a guide but free and easy to use with no credit checks involved.

3 easy steps to be ‘Mortgage Confident’

A few simple questions

Answer a few simple questions and we will connect you to your personal mortgage expert.

Expert Advice

Your expert will find the most suitable product for your circumstances, potentially saving you money.

Sit back and relax

All your application paperwork and follow up activities will be taken care of for you.

Download our FREE first time buyer’s guide

We’ll send you important industry news and information to keep you in the loop with what’s happening in the mortgage industry.

Why do I need Income Protection?

If you do not receive sick pay or when your sick pay ends income protection insurance is important to enable you to protect you & your families lifestyle. Income protection replaces your income at the point that you no longer receive an income.

You can use the money to cover important bills such as your mortgage/rent for you home as well as your basic living expenses such as food and utilities.

- Provide peace of mind in the event of injury/illness.

- Give stability for you & your family at a potentially uncertain time.

- Reduce impact on lifestyle (e.g. food, children’s clubs/activities etc.)

- Maintain your critical bills such as your mortgage/rent.

- Reduces the likelihood of ending upu in arrears/bad credit.

How long does income protection provide cover?

The length of time that your income protection covers you will dependent on the length of your term. As your income protection policy is protection to replace your income generally. It is recommended to take a policy until your planned retirement age.

Quisque nunc eros. Amet ultrices volutpat sed fringilla. Bibendum felis.

Sed a suscipit bibendum ornare scelerisque ultrices quisque nunc eros. Amet ultrices scelerisque ultrices quisque nunc eros. Amet ultrices volutpat sed fringilla.

Quisque nunc eros. Amet ultrices volutpat sed fringilla. Bibendum felis. scelerisque ultrices quisque nunc eros. Amet ultrices volutpat sed fringilla

Your advisor will talk to you through your options and tailor your recommendation to meet your needs and budget.

Life insurance types

The two main types of life insurance are level term and decreasing term life insurance.

Level term

Level term life insurance pays is where the amount insured will remain the same during the term of your policy, so you’ll know exactly how much money your dependents will receive.

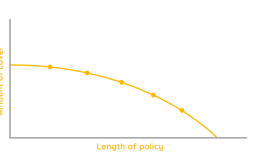

Decreasing term

Decreasing term life insurance is where the amount insured reduces during the term of your policy. This is often used to cover debts such as a repayment mortgage.

Life insurance considerations

Single or Joint Policy

A joint policy only pays out when the first person passes away and so it is cheaper. Would a joint policy be suitable or two single policies required?

Your Families needs

How much would your family need to cover debts/mortgages? Would they need money to replace your income? Are there other financial considerations that your would want to take core of?

Length of policy

When will you debts/mortgage be paid off? How long would your family be dependent on your income? When do you intend to retire?

When would I need life insurance?

Life insurance provides financial protection for the people that depend on you in the event that you die. There are lots of circumstances where it may be appropriate to think about cover in place.

Couple / Married

As a couple you might have bigger joint financial commitments than you want to protect.

Children / Dependents

When depend on you financially its reassuring to know that are protected if anything happens.

Home / Property owner

As a property owner you may have a debt that will need to be cleared.

Funeral Planning

Life insurance can be used to help with the cost of your funeral.

Explore buy to let products

Buy to let remortgages

Remortgage your existing buy to let a better deal.

Buy to let remortgages

Remortgage your existing buy to let a better deal.

Buy to let remortgages

Remortgage your existing buy to let a better deal.

Buy to let remortgages

Remortgage your existing buy to let a better deal.

What our Customers say

Check what our customers are saying about us.

Common mortgage FAQ’s in Manchester

How does mortgage advice in Manchester work?

Mortgage Confident Ltd. is a company registered in England and Wales (Company Number 13240633) whose registered office is at 3000 Aviator Way, Manchester, M22 5TG is an appointed representative of Cornerstone Finance Group Ltd.

Cornerstone Finance Group Ltd is a company registered in England and Wales (company number 08458702) whose registered office is at Unit E, Copse Walk, Cardiff Gate Business Park, Pontprennau, Cardiff, CF23 8RB. Cornerstone Finance Group Ltd is authorised and regulated by the Financial Conduct Authority. Financial Services Register number is 767272.

When should I obtain my agreement in principle in Machester?

Mortgage Confident Ltd. is a company registered in England and Wales (Company Number 13240633) whose registered office is at 3000 Aviator Way, Manchester, M22 5TG is an appointed representative of Cornerstone Finance Group Ltd.

Cornerstone Finance Group Ltd is a company registered in England and Wales (company number 08458702) whose registered office is at Unit E, Copse Walk, Cardiff Gate Business Park, Pontprennau, Cardiff, CF23 8RB. Cornerstone Finance Group Ltd is authorised and regulated by the Financial Conduct Authority. Financial Services Register number is 767272.

How does mortgage advice in Manchester work?

Mortgage Confident Ltd. is a company registered in England and Wales (Company Number 13240633) whose registered office is at 3000 Aviator Way, Manchester, M22 5TG is an appointed representative of Cornerstone Finance Group Ltd.

Cornerstone Finance Group Ltd is a company registered in England and Wales (company number 08458702) whose registered office is at Unit E, Copse Walk, Cardiff Gate Business Park, Pontprennau, Cardiff, CF23 8RB. Cornerstone Finance Group Ltd is authorised and regulated by the Financial Conduct Authority. Financial Services Register number is 767272.

Will having an agreement in principle taken out affect my credit score?

Mortgage Confident Ltd. is a company registered in England and Wales (Company Number 13240633) whose registered office is at 3000 Aviator Way, Manchester, M22 5TG is an appointed representative of Cornerstone Finance Group Ltd.

Cornerstone Finance Group Ltd is a company registered in England and Wales (company number 08458702) whose registered office is at Unit E, Copse Walk, Cardiff Gate Business Park, Pontprennau, Cardiff, CF23 8RB. Cornerstone Finance Group Ltd is authorised and regulated by the Financial Conduct Authority. Financial Services Register number is 767272.

Have any questions?

Speak to a mortgage expert.

Our experts will search 1000’s of mortgages to find the most suitable.